HARTFORD, CT, December 18, 2025 – IncomeConductor, the leading retirement...

Read MoreClarifying Retirement's Complexities

IncomeConductor brings retirement income planning into focus for your clients.

Retirement income planning is complex.

Investors are used to the challenges around accumulating, saving, and focusing on asset growth during their working years. However, when it comes time to begin planning for their retirement years, they face a whole new set of complexities.

Social Security Analysis

Tax Analysis

Cashflow Projections

RMD Projections

Roth Conversions

Longevity Planning

Medical Spending

Annuity Purchases

Legacy Planning

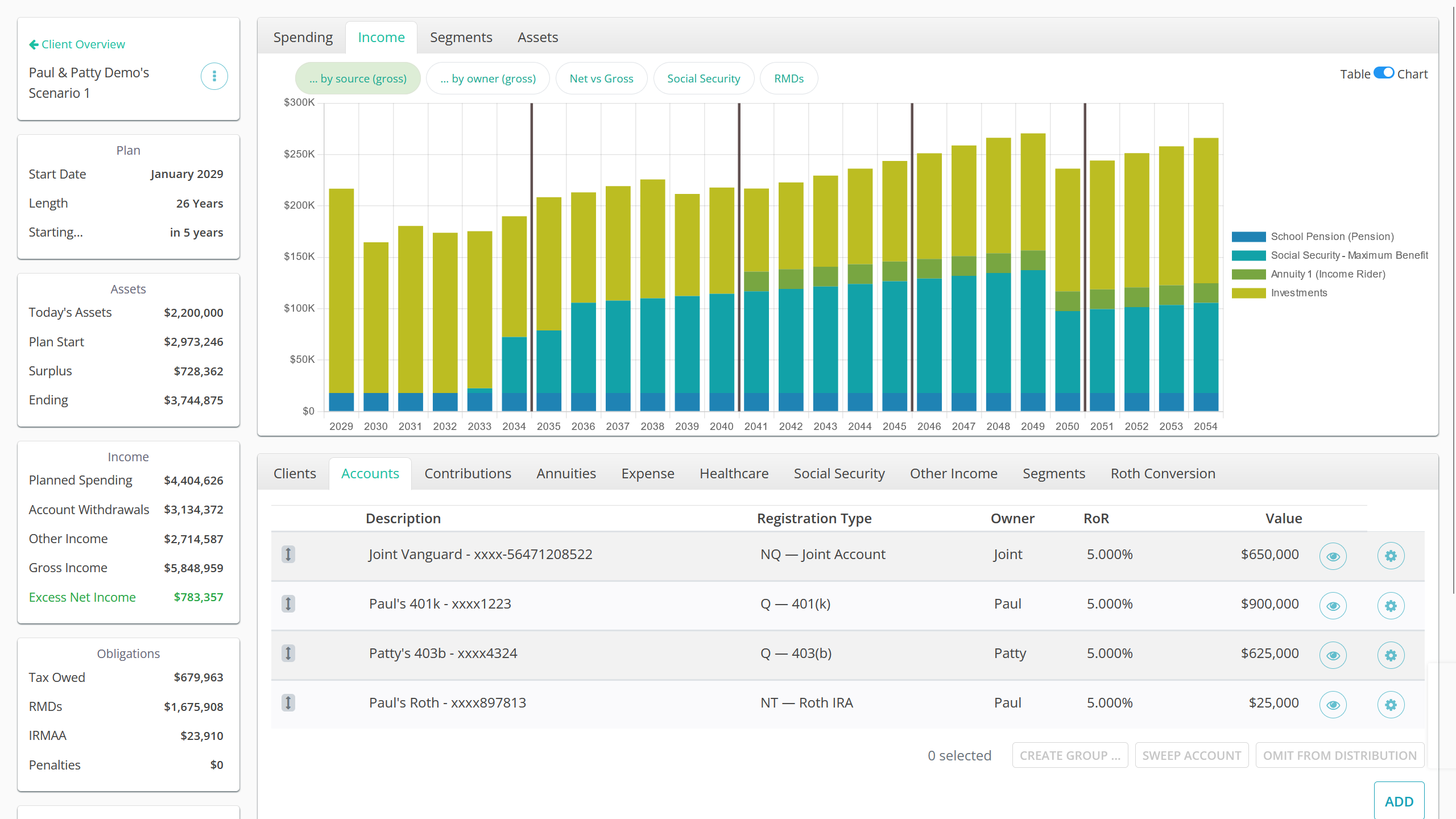

We put everything you need in one place.

No more switching between multiple planning tools to build your client’s retirement income plans.

See all of the retirement red flags, opportunities, insights, and solutions in one simple interface.

Red flags like Unfunded Income or high RMDs show up in the Plan Summary.

Opportunities to add value such as reducing Tax Owed or increasing Surplus assets appear as well.

Get instant insights into your client's plan with charts and tables that identify key trends in income, spending, account balances, and more.

Model all aspects of plan design in one shelf of tools.

Everything from account liquidation order, annuity purchases, and Social Security claiming strategies, to Roth conversions, healthcare spending, and time segmentation can be modeled.

Generating advisor value is our focus.

Whatever stage of your career you may be in, adding a specialty in retirement income planning can be transformative.

Caleb Allen, CPA, CFP®, AAMS®

Allen Financial Management

Cambridge Investment Research, Inc.

"IC Pro has helped fill in the missing and often unintegrated pieces of retirement income planning. We’ve been able to test and see updates in real-time in areas like liquidation priority, annuity strategies, Roth conversions, Social Security claiming strategies, effects of healthcare costs, and more which has facilitated better, more meaningful meetings with clients."

Jerri Hewett Miller, CFP®, RICP®

Wealth Horizon, Inc.

LPL Financial

"IncomeConductor is a vital part of our practice and, with the changing demographics, it will become even more important. People understand time segmentation or the 'bucket strategy', especially when they see the visuals. We look like geniuses.”

Brett Hulse, CFS

Laurus Financial Group

Osaic Wealth, Inc.

"The IncomeConductor retirement strategy has been the cornerstone of our practice for nearly 20 years and the primary driver of our success. IC Pro has elevated the retirement income conversation with our clients into distribution tax efficiency and legacy planning. It is the ONLY tool required to build a confident and reliable outcome for our clients as they transition into the retirement years."

J. Brian Glaze

Envision Wealth Partners

Avantax Investment Services

"IncomeConductor has changed our prospecting focus. We see a positive effect in client investment behavior because they clearly understand the WHY behind a particular investment strategy and what goal it is trying to accomplish."

Steve Kellar, CFP®

IHT Wealth Management

LPL Financial

"I have used many financial planning tools over 30+ years – this is the best for my pre-retiree and newly-retired prospects and clients. It’s well-designed for the client, it has a robust administrative platform for the advisor, and the support I’ve experienced from their team has simply been excellent."

Temp Davis, CFS

Integrated Financial Partners

LPL Financial

"IncomeConductor has made a big difference in the growth of my practice in the last two years. It provides a process that differentiates me from the wire houses and investment-only folks. The cases keep rolling in. Clients get it, it works, and it provides peace of mind both statistically and emotionally."

Scott Morrison

Morrison Nordmann Associates

Osaic Wealth, Inc.

“Prospective clients often ask, "Why should I work with you?" IncomeConductor is one of those tools that clearly differentiates myself within the financial services industry and allows me to easily communicate my unique value proposition to clients. When I ask a client why they chose me, they answer, "Because you had a plan".”

Sam Marrella, CFP®, RICP®

Marrella Private Wealth

"My clients’ reactions when I present their plans are always one of relief and confidence. They are relieved that they have a path forward to enjoying retirement without the constant worry about whether or not they will run out of money and they are confident because they have a plan that accounts for their major retirement risks. "

Integration is automation.

Plug into where ever your client accounts are held to speed up planning and automate tracking.

IncomeConductor News

Osaic Launches Advanced Retirement Income Planning Platform in Partnership with IncomeConductor

Osaic, Inc. (“Osaic”), one of the nation’s largest providers of...

Read MoreIncomeConductor Launches Integration with SS&C Black Diamond Wealth Platform

The IncomeConductor team is proud to announce that we have...

Read MoreIncomeConductor Launches Charles Schwab Data Integration

IncomeConductor makes creating and tracking your clients’ retirement plans simple...

Read MoreTry Pro free for 14 days.

Start a trial today and let us help you build your first case.