In a recent Morningstar article “Implementing a Bucket System? There Will Need to Be Some Rules“, Christine Benz lays out some of the questions that arise when advisors and clients employ bucket strategies in pursuit of retirement income. The main issues revolve around distribution of income, asset allocation and equity exposure, rebalancing, and portfolio modifications.

First off, we will begin by clarifying how broadly the term “buckets” has been used to describe a wide variety of strategies. Sometimes, buckets are strictly defined by the assets they hold, i.e. bucket one is always cash, bucket two is always a stock/bond mix, and bucket three is always stocks. This approach may seem to simplify the plan construction, but it also artificially limits the flexibility of the advisor to customize the plan to the client’s needs.

Other times, buckets are set up to accommodate whatever variety of assets the advisor and client choose to fund them with, but “cascade” into each other over time. This is a process where the dividends, interest and gains from the more aggressive buckets are redistributed into the income generating bucket, attempting to replenish a cash source as money goes out to the retiree.

Finally, there is a more pure segmentation approach where the individual buckets are designated to grow over set periods and distribute over set periods, with transfers between them only on a discretionary or emergency basis. We believe this approach offers the most positives while minimizing the negatives of a bucket strategy for retirement income. So how does this implementation of buckets address the issues raised in Benz’s article?

Challenge 1: Cutting the paycheck

One of the greatest perils to taking income from a pool of assets that no longer receives contributions is drawing down on principal unnecessarily. In an ideal scenario, the entirety of a client’s income could come from the dividends, interest and capital gains that their portfolio throws off. However, in market environments where interest rates are low, a 50/50 balanced portfolio of S&P 500 and Bloomberg Barclays Aggregate Bond indexes may only provide 2-3% of distribution yield before fees. These figures fluctuate over time, so some periods may provide enough, but others may demand that you liquidate assets and potentially consume principal as income.

By segmenting assets into set time periods, even if assets from the same account are spread across multiple segments prior to use as income, a plan is created that has rules around income distribution. These rules ensure that income comes only from sources that no longer have market exposure or are susceptible to value fluctuation. The assets in segments that are not in distribution remain untouched and the principal is free to grow over time, with whatever dividends or interest generated being re-invested for potentially enhanced total return.

Challenge 2: Finding your glide-path

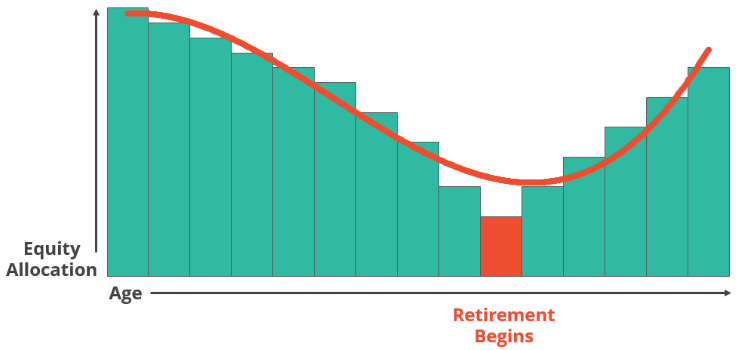

Choice of investment allocation is critical to any income plan. The asset classes used and the proportions in which you use them will significantly affect the growth potential and volatility of the portfolio. Since we are looking at bucket strategies, this selection process expands from a single portfolio approach to a glide-path approach where multiple portfolios are constructed with specific time horizons. The term glide-path has become closely associated with target-date retirement funds such as those found in 401(k) plans. However, because those funds are for savers who are contributing during their careers and the “target date” is their anticipated year of retirement, they feature glide-paths that almost always shift in allocation from aggressive to conservative over time.

During retirement, there is no longer the luxury of periodic contributions, so growth of the portfolio must be achieved through investment return, all while providing income and hopefully keeping up with inflation. Due to these requirements, risk must be taken with portions of the asset pool or else potential income will suffer. In our article Risk Assessment Through the Lens of Rolling Returns, we discuss how time in the market is critical to reducing downside potential, and settling upon realistic goals. A key element of a bucket approach is to acknowledge this reality, and use it to your advantage. In other words, a rising equity glide-path from the beginning to end of the income plan can help to provide the investment returns needed to sustain a steadily growing income stream. The figure below shows the resulting investment glide-path for the full accumulation and distribution cycle of an investor.

Challenge 3: To rebalance, or not to rebalance

Rebalancing is the act of trading in a portfolio so as to return each asset class or security back to, or closer to, the original target allocation for that holding or group of holdings. There is debate over the optimal period a portfolio should be allowed to “drift”, or let its holdings stray from their target allocations before a full or partial rebalance is performed. Some argue for quarterly, some for annually, and others for a more subjective approach based on how the portfolio’s asset classes or holdings are positioned versus current broad market valuations.

A study in 2008 by Marlena Lee of Dimensional Fund Advisors, entitled Rebalancing And Returns, concluded that there is no consistently optimal time period for rebalancing, and that it is risky to assume a specific return premium based on a particular rebalancing schedule. Lee concludes that in a way, this lifts a burden from the advisor and client by giving them flexibility around what they feel is the most advantageous rebalancing regiment, based on their own sensitivities to portfolio risk and drift.

In retirement income plans using bucket strategies, this decision may often be driven by tax implications. Rebalancing a non-tax-deferred account in a segment that is due for liquidation soon may not make sense. Conversely, a tax-deferred account in a segment not needed for many years may make the decision to rebalance easy. In short, there is no golden rule for rebalancing, and a strategy for doing so should arise from a discussion between advisor and client with their unique scenario in mind.

Challenge 4: On-going portfolio management

Retirement income plans can stretch over very long time horizons, and a lot will change in the course of a retirement. One of the most important roles that the advisor must fill for the client is that of plan manager, and this goes far beyond simply picking investments and asset managers for the various funding accounts. Reacting to whatever situations arise in the life of the client, or in the course of market cycles, is a critical duty of the advisor that helps them calm the often turbulent seas of emotion associated with distributing income.

A routine, periodic schedule of review meetings makes sense for most advisor/client relationships so that a general state of affairs can be established and agreed upon. Some folks may find once a year sufficient, while others may seek to meet more frequently. Either way, a clear, concise review should be provided to clients that shows plan versus actual segment values while affording the opportunity to memorialize decisions made and the rationales behind them. This practice not only makes maintaining your plan a smooth and repeatable process, but it also helps to protect everyone involved down the road if a particular action is called into question.

Opportunities may arise during the course of a client’s retirement where the advisor can dial back some of the market risk that is being taken in a later segment. Perhaps a segment has performed beyond expectations, or the client’s needs have changed such that less income will be required for that time period. This kind of goals-based de-risking is what makes an effective income plan manager so valuable, and what allows the advisor to protect the success of a client’s retirement experience. It’s also a technique that is unique to a carefully crafted bucket strategy. A watchful eye on all remaining time horizons of the plan can ultimately increase client income, and potentially avoid a disaster.

Learn More

Bucketing strategies, or time-segmentation as we call it, can be effective, easy to understand, and powerful when done right. Advisors and clients will have a full plan map from day one with the tools to adjust the plan as necessary in the future.

For more information on how advisors using IncomeConductor easily create, implement, and manage retirement income plans for clients of all asset levels and lifestyles, Contact Us and schedule a demo today.