Retirement income generation is a complex problem that advisors are tackling in a number of different ways across the financial services industry. Many large providers are focusing on single product strategies that are supposed to generate income through dividends and interest. Some advisors are using a basic systematic 3-4% withdrawal strategy. However, many advisors are embracing the concept of time segmentation as the foundation of their retired clients’ income plans.

So what is Time Segmentation?

Simply put, time segmentation is the process of separating assets into distinct segments, based on how long we intend to grow each group of assets in the market, and then how long we intend to provide monthly income with them. Rather than drawing income distributions from a single portfolio that is subject to market volatility, segmentation is designed to provide income from a non-market source, such as cash. Those assets that have market exposure do not contribute to immediate income, but are left alone and given time to grow in later segments for use as future income. Let’s look at an example.

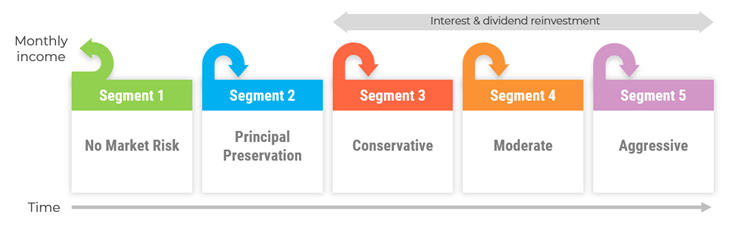

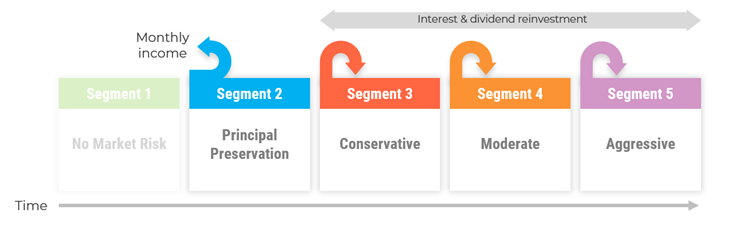

In the figure above, there are five segments that make up the plan and each segment represents a group of assets that are invested on day one. Every segment has a length of time it is intended to distribute income. The length of these segments can vary, but we often see plans with segments of about five years each, so we’ll assume that is the case here. In this example, Segment 1 would distribute a monthly income for the first five years of the plan. At the end of year five, Segment 2 would be moved into a No Market Risk asset, and would begin distributing monthly income for plan years six through ten as shown below.

You can see that segments three through five, which represent plan income years 11 through 25 have stayed true to their original investment style. This is an important feature of segmentation, as those assets were originally invested with a specific time horizon in mind. By allowing the intended time horizon to fully elapse, those assets have a greater chance of achieving enough growth to fund income in later years, even if markets have fluctuated in the short term.

What happens if the segment growth goals aren’t met?

Unlike other strategies where you are drawing upon one large portfolio, and potentially dipping into your principal when markets are down, segmentation keeps assets separate. The risk of catastrophic failure where you completely run out of money is removed, and instead, there is only a risk that income in later years may not keep up with inflation, or just be less than you were aiming for. For the more conservative planners, an extra segment can be created that doesn’t have a specific time horizon, but acts as more of an emergency fund that can be accessed as necessary.

What happens if I exceed my goals?

Because the assets are separated, time segmentation gives an advisor the ability to look far out into the future of an income plan, and keep an eye on the investments specifically targeted for future income. Rather than making a change to one large portfolio, which can be hard to quantify, an advisor can adjust each segment individually. In a situation where goals are exceeded, it may even be possible to reduce the market exposure in those later segments, and still achieve the intended income level. This is what we refer to as goals-based de-risking, and is a powerful tool in the advisor’s toolbox when using time segmentation.

Time segmentation is all about clear, intuitive planning and most importantly, the ability to make tweaks and course-corrections along the way. These elements combine to create a retirement experience that provides stability and peace of mind.

How do I get started?

Whether you’re an advisor who is interested in learning more about time segmentation for your retirement income clients, or you’re an individual nearing (or in!) retirement looking for an advisor to help you structure and manage a segmented plan, Contact Us today.